A weird complacency seems to have settled over Wall Street.

Stock prices are at a record. The S&P 500 broad index, currently at 1950, is remorselessly approaching 2000. It’s been climbing with hardly a pause for breath for more than five years. That’s becoming quite a long stretch. It’s now about 26% above the last major high of 1576 in October 2007, before it got smacked all the way down to 676 in March 2009 by the Global Financial Crisis.

Trading volumes continue to drift lower. Indexes measured by the Federal Reserve of market stress and volatility (shown below) are at generation lows. People are even giving up watching CNBC for market news! It’s an eerie calm:

However, prices are now such that, on just about every respectable measure of value, the market is well overvalued, and likely near a top:

- The CAPE Schiller P/E that measures long term earnings performance against prices is at 25 compared to it’s long term median of 16

- The ratio of total market capitalisation to GDP (Warren Buffett’s favourite yardstick of value) is at 1.27 compared to it’s long term median of 0.65

- Tobin’s Q ratio, which (for the non financier) represents ratio of market value to the underlying asset replacement value is at 1.09 compared to it’s long term median of 0.70

And just look at this long view of the S&P 500 index. It makes you wonder if the world really has gone crazy (again). That little red circle highlights the October 1987 stock market crash that wreaked considerable havoc at the time. It is one of the things that led Australia towards “the recession we had to have”: (and we haven’t had one since!)

These indexes, and the doziness in the market, consistently point to the widespread belief that what has been going up since 2009 will just keep going up.

Why? Because the US Federal Reserve continues to hold interest rates near zero and pump virtually free new money into the financial markets. About $3.3 trillion since the GFC. Fed Chair, Janet Yellen, continues to assure the world that things will stay “supportive” for however long it takes. The Fed’s intent/plan is that Wall Street is supposed to push (at least some of) this new money into the real economy to help kick it along. That’s what they say, anyway. But it hasn’t worked out that way.

Instead it has just inflated asset prices off almost the charts. Record stock prices. Strangely high bond prices (because of the freakishly low interest rates). Record corporate merger and acquisition activity (which rarely adds any real value in the economy). Record share buy-backs (raising ultra cheap debt for the corporations, goosing the returns to their shareholders, and enhancing executive bonuses based on share price performance). Record margin lending. And, some completely absurdly valued new listings coming on to the market.

That’s all financial market stuff, mostly benefiting the players in that market.

Wall Street is, of course, still the key global equity capital market. So often does it provide a “lead” to many other markets. So those too have seen the share prices rise above typical and historically fair values. (With the curious exception of China, where despite the fact that China’s economy is supposed to be the saviour of the world economy, the stock market is lower than when the GFC hit. Hard to explain that, really.)

This same behaviour of asset prices is reflected in high end property. In just about every major centre in the world (particularly those where the 1% congregate), property prices have been rising at rates anywhere from 15% to 30% per year.

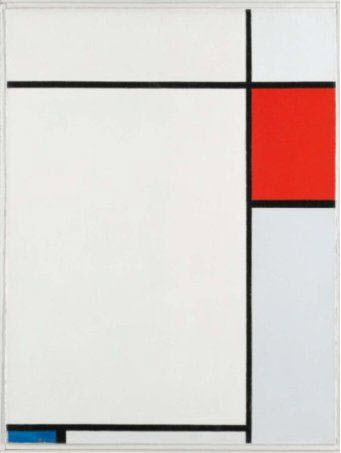

And even in the fine arts, prices are going crazy. Look at this:

Like it? … Someone does.

They’ve just paid almost $US 26 million for it at Sothebys. Hmmmm …

And then when you look for the signs that these market values are reflective of the health of the real US and world economy, they simply aren’t there.

US GDP fell by about 1.6% in the first quarter of 2014. Real average wages have not risen since the 1960’s, and they’ve certainly done nothing but fall since the GFC. The great US middle class consumer is being crushed: borrowing more and enjoying it less.

Extended monetary stimulus in Japan has dropped the value of the yen, created trade deficits, boosted the stock market, and introduced consumer inflation whilst seeing real wages continue to fall. That’s an epic fail.

In China the stories of debt defaults, missing collateral, and imploding property markets, continue to mount. It’s hard to believe much of the “good” economic “data” coming from there.

And Europe stumbles along with it’s massive unemployment staying high, no economic growth, and now, negative interest rates.

What about world trade? Well, the Baltic Dry Index, a keenly watched daily assessment of the price of moving the major raw materials by sea, and a good indicator of the health of world trade in major dry commodities like iron ore, coal and grains, is having its worst year ever. The Index has slumped to 12-month lows (867) and is showing absolutely no signs whatsoever of the renaissance in global growth that has been heralded.

In other words, I find it really hard to find convincing evidence from the major economic engines of the world (USA, Europe, China and Japan) of the justification for the optimistic values on Wall Street and other “following markets”.

Sooner or (maybe not much) later, hard economic reality is going to catch the bankers out.

So, with all the above happening, and with the rumbling turmoil very nearby, is Dubai showing the way? The whole Dubai market’s capitalisation is only about half that of Apple, so it’s a minnow. But that’s a big drop in 6 weeks. Enough to put the scare into other financial markets maybe? …

Excellent post Geoff…..you have me convinced