Highlights from yesterday’s US Government press release on jobs:

- unemployment down in one month from 7% to 6.7%;

- 74,000 new jobs created in December.

Sounds OK doesn’t it? The economy must be recovering … (Wall Street rose a bit on the news.)

As usual the Government, the politicians and the popular media played to the optimism bias and painted as rosy a picture as possible. But it’s a complete delusion.

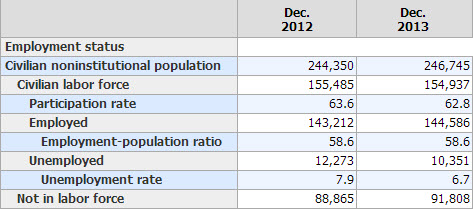

Here are some real numbers clipped straight from the website of the Government’s Bureau of Labor Statistics:

Yep … there’s the 6.7% unemployment rate, down from 7.9% a year ago …

But hang on, there’s more to this story. According to the BLS, in the year 2013:

- The total population theoretically capable of work ROSE 2.4 million to 246,745,000 …

- … but, the workforce FELL 548,000 to 154,937,000

Almost 3 million were defined as no longer in the workforce. That’s more than twice the 1,374,000 that found employment in 2013.

Add to this the following:

- More than half the new employment was temporary and part time employment.

- Average weekly earnings rose just under 1.5%, a fraction less than the BLS’ measure of inflation.

So … real income for those with a job went nowhere, and the extra 3 million without one had to live off debt, savings or handouts.

In which universe does this look like sound economic recovery for the vast majority of American households?

Sure, the $1+ trillion of new money created by the Fed pumped Wall Street up 30%. But that benefited only the very top dogs. Banks and corporations sit on huge piles of cash and Mr and Mrs Average barely keep afloat.

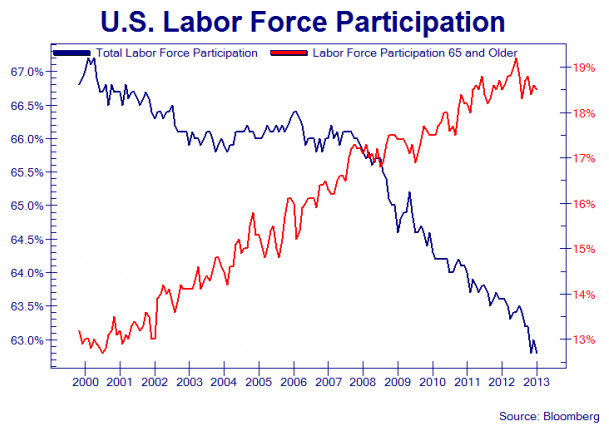

While we’re on jobs, here’s another significant structural problem in the US labour market. (And potentially a source of inter-generational resentment.) Over 10 years, not only has proportion of the population engaged in work fallen, the older generation has stayed on in the workforce in greater numbers, obviously at the expense of the younger generations.

Note particularly the steep decline in the blue line since 2008.

These trends and dynamics of 2013 in the US simply can’t be sustained. But, most commentators see the US as the great hope for growth because Europe is mired in misery; the great economic sleight of hand experiment in Japan is starting to go pear shaped; growth in China, the other BRICS, and other emerging economies is becoming suspect.

It will be fascinating to see how 2014 plays out. The longer the trends of 2013 continue the bigger will be the bang when it inevitably comes.

Hang on to something … this will be interesting to watch …